DraftKings Sportsbook

DraftKings is among the largest US sportsbooks, boasting extensive sports market coverage, a barrage of unique props, and exceptionally generous bonuses. It was founded by Jason Robins, Paul Liberman, and Matthew Kalish in 2012, is headquartered in Boston, and is available in 22 US states.

As a passionate sports fan and sportsbook expert, I’ve been testing DraftKings for over 5+ years. Whether you’re completely new to online sports gambling or a seasoned bettor looking for advanced betting tips, I believe my review of DraftKings will be able to help you enjoy a more pleasurable experience on this sportsbook.

Here’s a quick overview of the most prominent advantages and drawbacks of choosing DraftKings:

Gamble USA strives to improve your online gambling experience. We aim to help you play safely, make informed decisions when gambling, and increase your betting knowledge through our guides.

We adhere to strict editorial integrity; our content may contain links to products from our licensed & legal US partners.

Pros

- Available in over 22 US States

- Accepts deposits as low as $5

- Hefty welcome and referral bonuses

- Thoroughly streamlined bet builder feature

- Futures, props, parlays, and specials available for all major events

Cons

- The live chat function doesn’t always work properly

- Does not list the number of active markets per category

DraftKings Overview

At first glance, DraftKings isn’t too different from other major sportsbooks. All available betting markets can be seen in the left sidebar; the lobby screen features a revolving list of active promos, and one of the most popular matches will be displayed so that you can see how DraftKings selections look and work.

The beauty of this sportsbook, though, is in the details, so here are my first impressions of how DraftKings stands out:

- The bet slip is embedded and will “follow” your cursor as you scroll so that it’s always easy to access;

- American odds are selected as default, so you don’t have to chase formatting functions;

- Tons of filters like A-Z sports, Sports Teams, Playoff Pages, and Championship Pages make navigation a breeze;

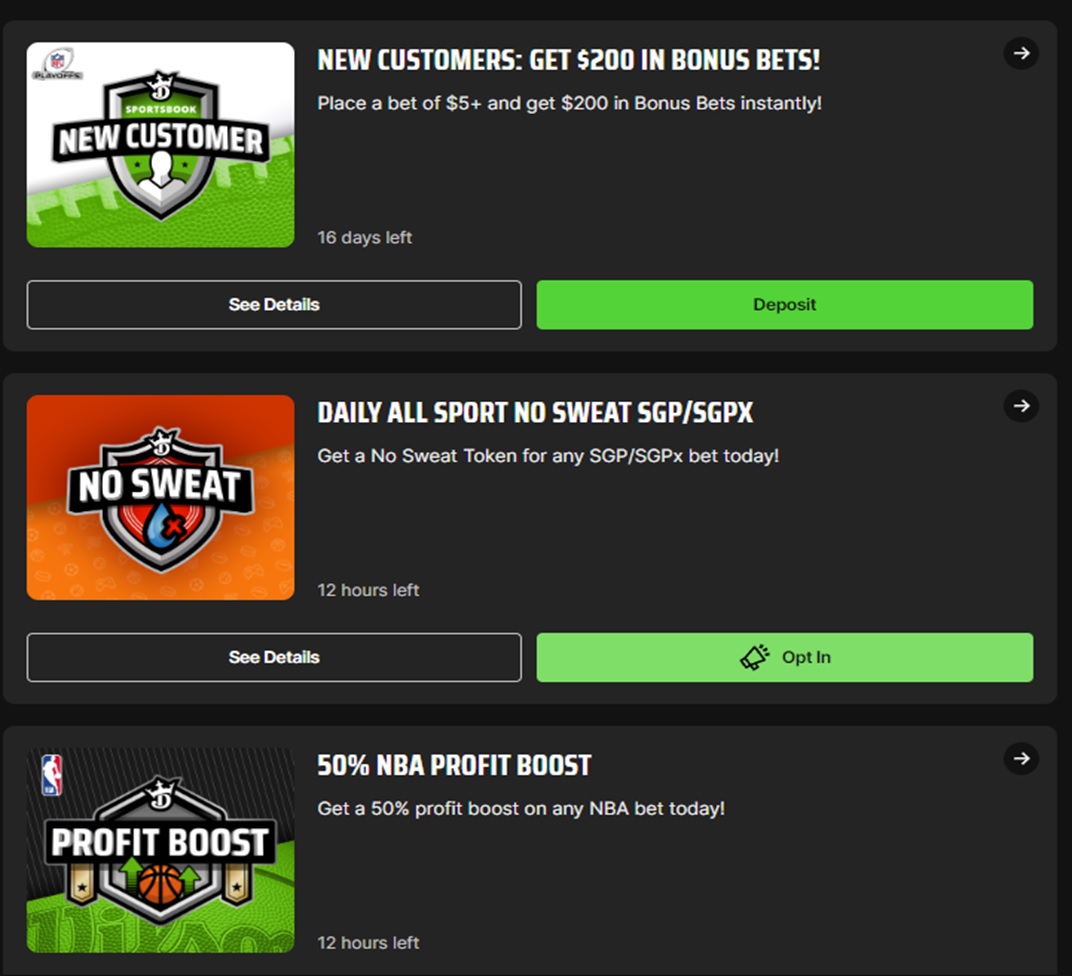

- The Promotions section also has filters, as well as quick descriptions and indicators of how long each promo will remain active;

I fell in love with this sportsbook mainly because of these seemingly minor QOL improvements.

Here’s a few quick facts about DraftKings you might be interested in:

| DraftKings Sportsbook | |

|---|---|

| Founding date | 2012 |

| US availability | Over 22 states |

| Welcome Bonus | 20% deposit match of up to $1,000 |

| Other promotions | Refer-a-friend, $200 in Bonus Bets, numerous Profit Boost promotions, Loyalty Program |

| Sports market coverage | 20+ |

| Features a casino segment | Yes |

| Live Betting | Yes |

| Mobile Apps | Android and iOS |

DraftKings Bonuses & Promotions

Throughout my testing of DraftKings, I’ve seen dozens of offers come and go, but some have remained consistent with only the numbers changing slightly over time. Let me break down what DraftKings typically offers to its new and existing customers.

Welcome Bonus

DraftKings has always welcomed its newest members with a hefty bonus on their first deposit. The 20% match of up to $1,000 is the most up-to-date offer for newcomers, which becomes available as soon as you register and verify your account.

DraftKings welcome bonus is decently large compared to the online sports betting industry standard, but what truly sets it apart from the rest is the 25x wagering requirement.

To claim this bonus in full, you will need to deposit $5,000 and play through a total of $25,000 in cumulative wagers with odds of at least -300 within 90 days to receive your $1,000.

New Customer Bonus

Debatably the best DraftKings promotion is its New Customer Bonus, which offers a whopping $200 in bonus bets as soon as you make a minimum deposit of $5. More specifically, this will make you eligible to receive 8 bonus bets of $25, which you can use on any sports selection.

Simply deposit $5 in your account, wager the full amount on any market, and eight $25 bonus bets will be allocated to your profile regardless of the outcome.

There are no strings attached to the New Customer Bonus, but you will need to use all of your Bonus Bets within 7 days of activating this promotion.

Refer-a-Friend Bonus

The way this bonus works is quite simple. After registering an account with DraftKings, you can generate and send a unique referral link to up to 5 friends. They must then use your referral link when creating an account, and once they deposit the required number of funds, both parties become eligible to receive some bonus cash.

More specifically, if your referrals make a deposit:

- From $25 to $49, both you and your referral receive two 100% Profit Boosts;

- From $50 to $99, both you and your referral receive five 100% Profit Boosts;

- Upward of $100+, both you and your referral receive ten 100% Profit Boosts.

These “Profit Boosts” are consumable bonuses that amplify your winnings by a set amount. In the case of Refer-a-Friend PBs, you’ll essentially get to double your earnings on a chosen selection.

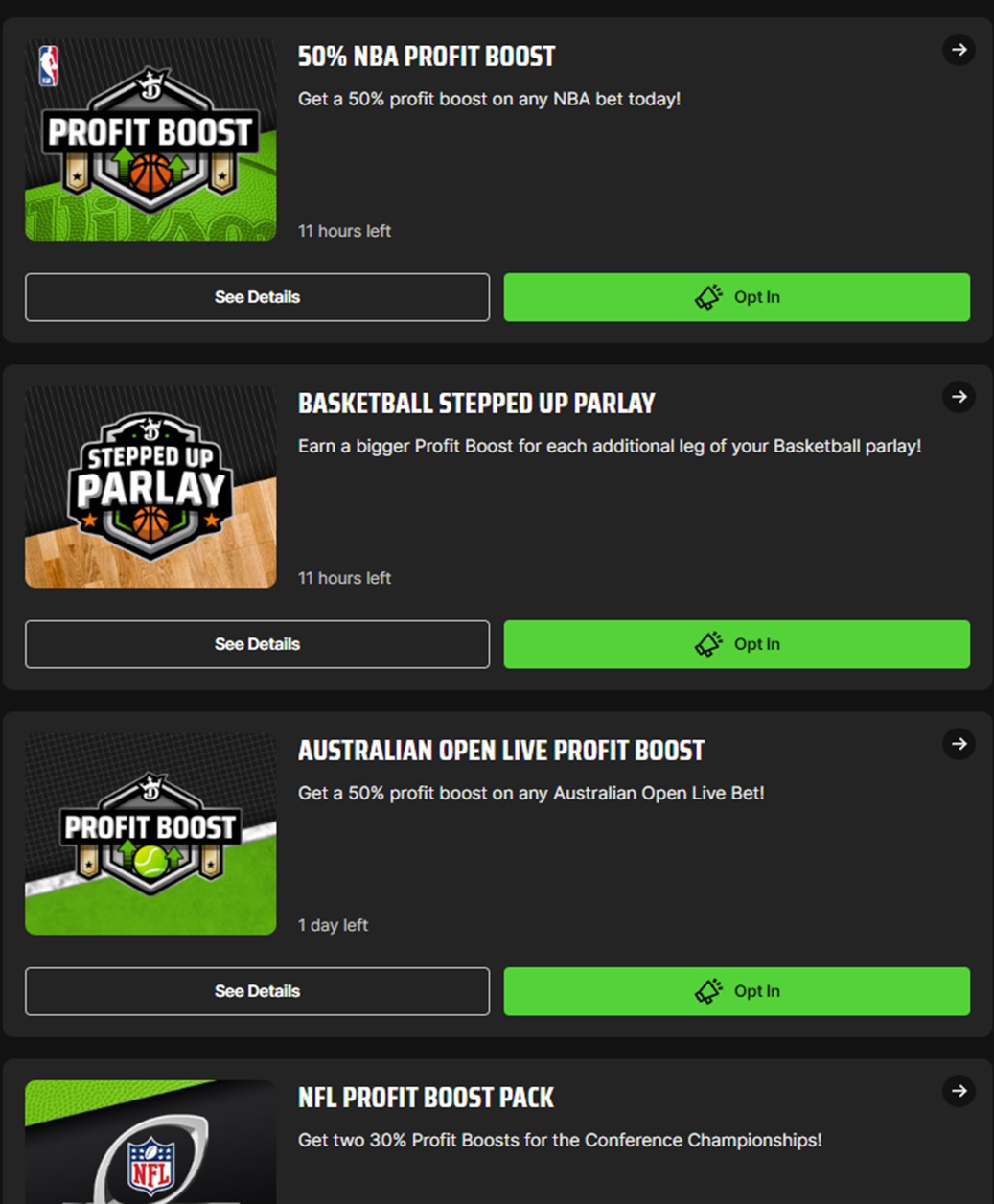

Sport-Specific Promotions

DraftKings regularly launches new promotions that target sport-specific events or categories. These are usually profit boosts or “no sweat” (insurance) tokens, which function a bit differently from other DK bonuses, so let me briefly explain how they work:

- Market-specific Profit Boost: unlike “global” profit boosts from Refer-a-Friend promotions, you can only use these boosts on featured events. For example, the 50% NBA Profit Boost can only be used on NBA Basketball matches (and not on NCA, CBA, or any other basketball event);

- No Sweat Tokens: these promotions are usually parlay insurance tokens, offering a portion of your wager back should the selection lose. Similar to market-specific profit boosts, No Sweat Tokens are also sport-specific and can only be used on featured events;

- Stepped-up Parlay: this is a unique form of Profit Boost that doesn’t add a fixed percentage to your winnings. The more legs of a parlay you include and win, the higher the percentage of the boost will become. For instance, the Basketball Stepped Up Parlay starts modestly at 20% Boost on 3-leg parlays and goes up to 100% on 10+ leg parlay bets.

DraftKings Dynasty Rewards Program

One of the more confusing things about the DraftKings Rewards system is that it’s actually divided into “VIP” and “Dynasty” sections. The latter is more similar to a multi-tier VIP system complete with five levels with progressive and unique perks.

The way it works is quite simple – for every $1 you wager, you get Tier Credits and make progress toward the next tier, which include:

- Bronze: no Tier Credits required, all players initially start at this level;

- Silver: unlocked by reaching 5,000 Tier Credits, unlocks tier-exclusive contests and promos;

- Gold: unlocked by reaching 25,000 Tier Credits, expands on Silver rewards, and brings priority customer support to the table;

- Diamond: unlocked by reaching 90,000 Tier Credits, unlocks 24-7 chat support and annual Diamond Gifts;

- Onyx: the ultimate level for players who accumulate 175,000 Tier Credits. Unlocks the best versions of the aforementioned perks plus Onyx Elite Rewards.

Besides Tier Credits, you’ll also accumulate “DraftKings Crowns”. These can be redeemed for DK Dollars at a rate of 550:1, used in DraftKings Marketplace, or as tickets to exclusive contests and events.

DraftKings VIP

The VIP program can be considered the last part of the Dynasty Rewards, but unlike all the aforementioned tiers, the only way to reach this coveted status is to receive a personal invitation from the sportsbook’s business executive.

Players can request to become a VIP by tapping “VIP” from the top-menu shortcuts, and answering a few questions. That is not to say that you’ll be guaranteed to be invited if you get the answers right – only players with a long track record who’ve spent quite a few dollars on this platform are eligible.

Being a DraftKings VIP member has dozens of unique perks like access to custom promotions, exclusive events, and more.

DraftKings Betting Segments & Features

In the following sections, I’ll dissect the main wagering features of the DraftKings Sportsbook. Hopefully, this will help you learn how to place and edit bets, use the live sportsbook segment, and more.

Live Betting

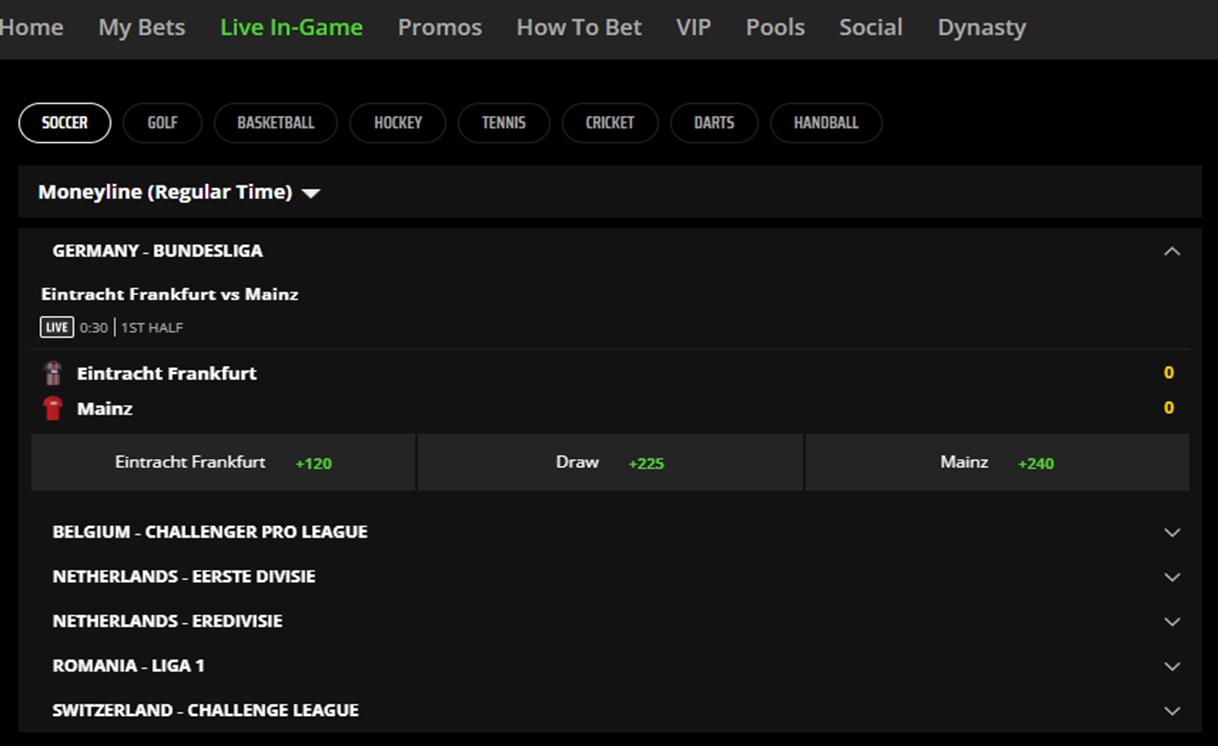

At DraftKings, live sports betting has been made purposefully as simple as possible, mainly to ensure that even first-time sports bettors can enjoy it.

To start betting on live events, simply tap “Live In-Game” from the top menu. The bar below will outline which markets are currently available, so simply choose what sports you want to bet on.

After choosing a category, you will see a list of available matches along with featured bet selections. Tap on the highlighted selection, and you will see a drop-down list of available props, if any are available. Choosing a new option will automatically filter available selections that include it.

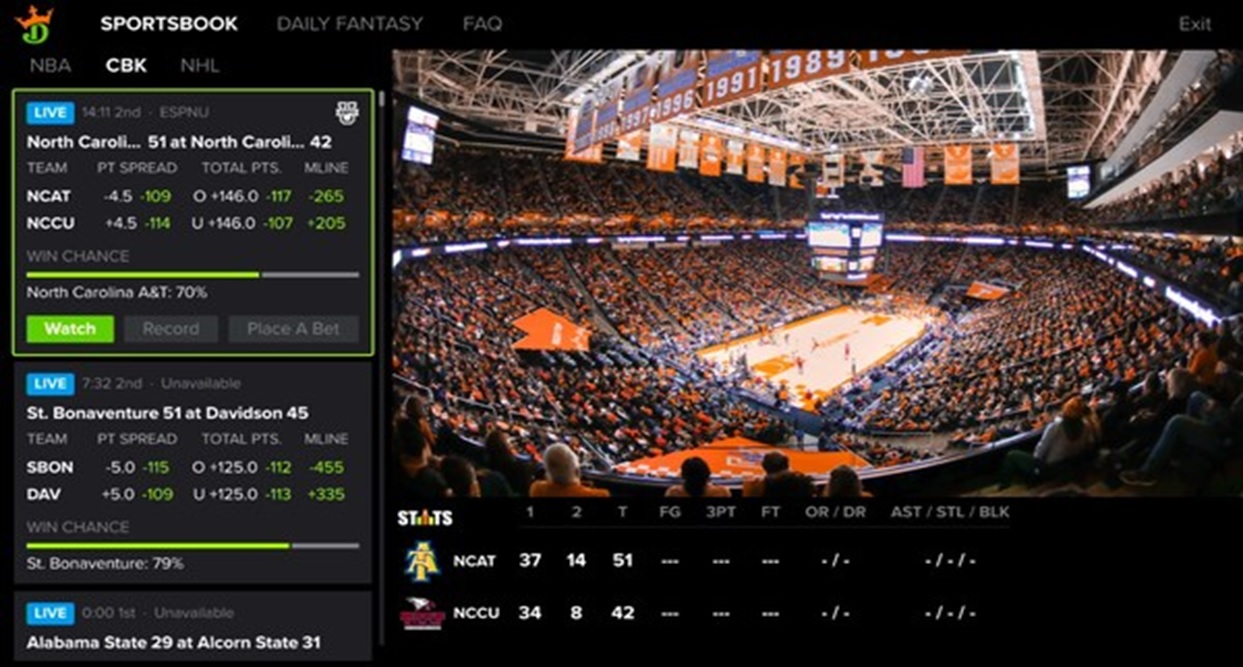

Live Streaming

DraftKings introduced live streaming functions merely a few years ago, but this feature is fully online now and mostly bug-free.

The main issue is that you’ll have to manually “hunt” for games that are streaming live. You’ll recognize them by a small “TV” icon next to the match; tapping on any of these selections will take you to a new screen with options and odds unique to this selection, as well as a slightly different interface.

Bet Builder

Similarly to most modern sportsbooks, betting at DraftKings operates on a simple principle. Just tap the selection you wish to bet on, and it will instantly be included in the bet builder.

You will then be prompted to select the size of your wager on each selection, use Profit Boosters (if you have any), or even merge your picks into a parlay (if possible).

Speaking of which, same-game parlay bets are almost always allowed if you’re betting on singles in Soccer, Basketball, and select Baseball games. Obviously, conflicting choices (e.g. selecting both Over and Under) are not applicable, and using certain props is not allowed in several categories.

DraftKings Banking and Payouts

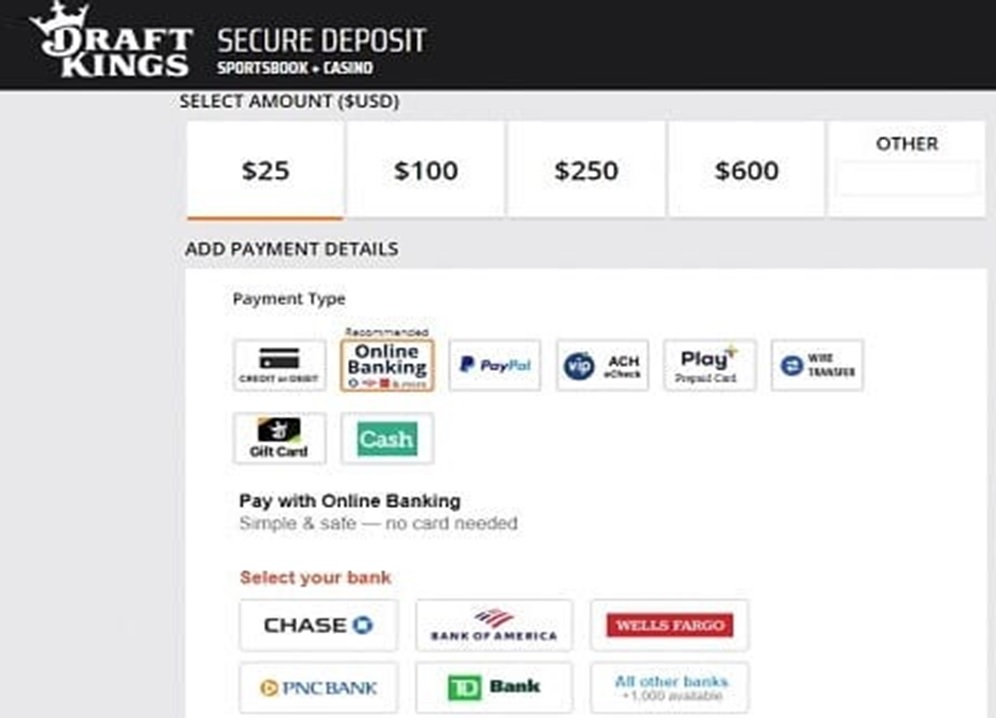

DraftKings offers a variety of payment methods, including online banking, credit & debit cards, e-wallets, e-checks, and gift cards. In my experience, what sets this sportsbook apart from competing platforms is that they’ve succeeded in integrating the safest and fastest financial systems and cover all prominent payment categories. Simply go to the Cashier to manage your deposits and withdrawals.

Deposits & Withdrawals

One of the reasons why DraftKings is the leading sportsbook in the United States is that they don’t charge any fees on their deposits. Moreover, the minimal amount of cash you can place is just $5, which is several times lower compared to some alternatives.

The minimum withdrawal limit is usually $1, and similar to deposits, no transaction fees are charged.

Below is the list of specifics regarding the most popular DraftKings payment systems:

| Payment Method | Deposits | Withdrawal Minimum/Maximum | Withdrawal Processing Times |

|---|---|---|---|

| Online Banking | $5 | $1 - $100,000 | Up to 5 business days |

| PayPal | $5 | $1 - $60,000 | Up to 2 business days |

| Credit Cards | $5 | $1 - $60,000 | 1 day |

| Venmo | $5 | $1 - $20,000 | Up to 2 business days |

| Check | N/A | $15 - $2,000 | 5-14 business days (3 if VIP preferred) |

| Bank Wire Transfer | N/A | $20,000 - N/A | Up to 2 business days |

| Apple Pay | $5 | $1 - $25,000 | 1 day |

| Trustly | N/A | $1 - $100,000 | 1 day |

It’s important to note that available payment systems vary from state to state. For example, American Express is exclusively available in New Jersey for depositing at DraftKings sportsbook and online casino while everyone can use it to make deposits at DK Fantasy Sports.

DraftKings Sportsbook Odds

DraftKings has consistently been regarded among the most competitive sportsbooks, and the fact that it retained this status for over a decade largely stems from its ability to provide exceptionally generous odds across virtually all sports betting categories.

From football, basketball, and hockey to combat and cycling sports, and beyond, this platform offers not only great odds, but also a regular supply of boosters that can make your selections up to twice as profitable.

DraftKings Security

This sportsbook is famous for its sophisticated geolocation technology that automatically prevents players from non-supported territories from even creating an account, let alone placing wagers and cashing out.

Moreover, its tight SSL encryptions are regularly updated to stay ahead of bad actors and cutting-edge malware.

DraftKings has also partnered with land-based casinos in several US states, with the most prominent being its Baton Rouge venue in Louisiana.

Customer Support

The DraftKings platform is absolutely massive, complete with Daily Fantasy, Sportsbook, Casino, Marketplace, Reignmakers, and DK Shop segments, each featuring numerous subsections and categories. Its sportsbook alone is huge as well, covering over 20+ sports markets, so I find it understandable that many players don’t even know where to start when signing up.

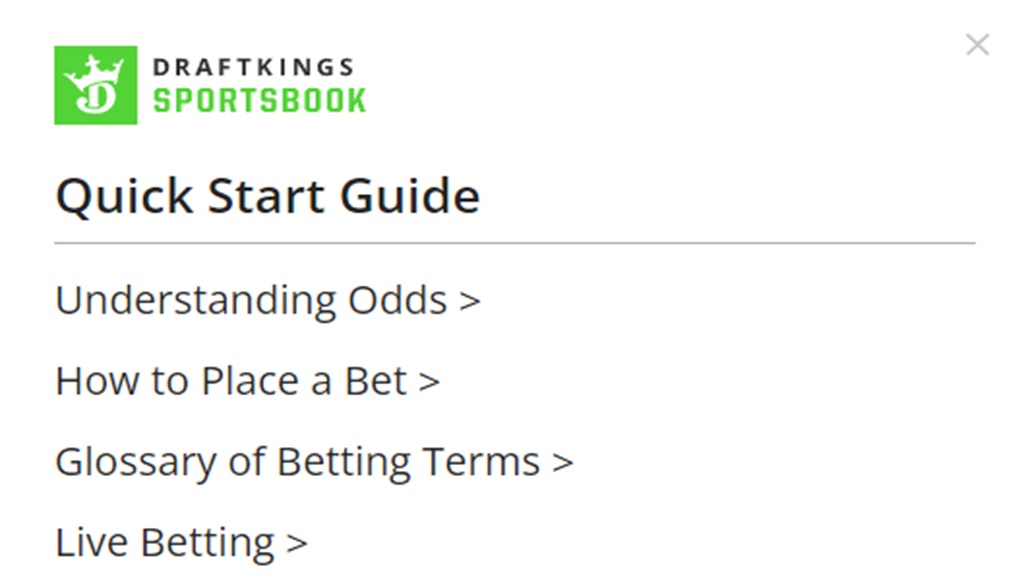

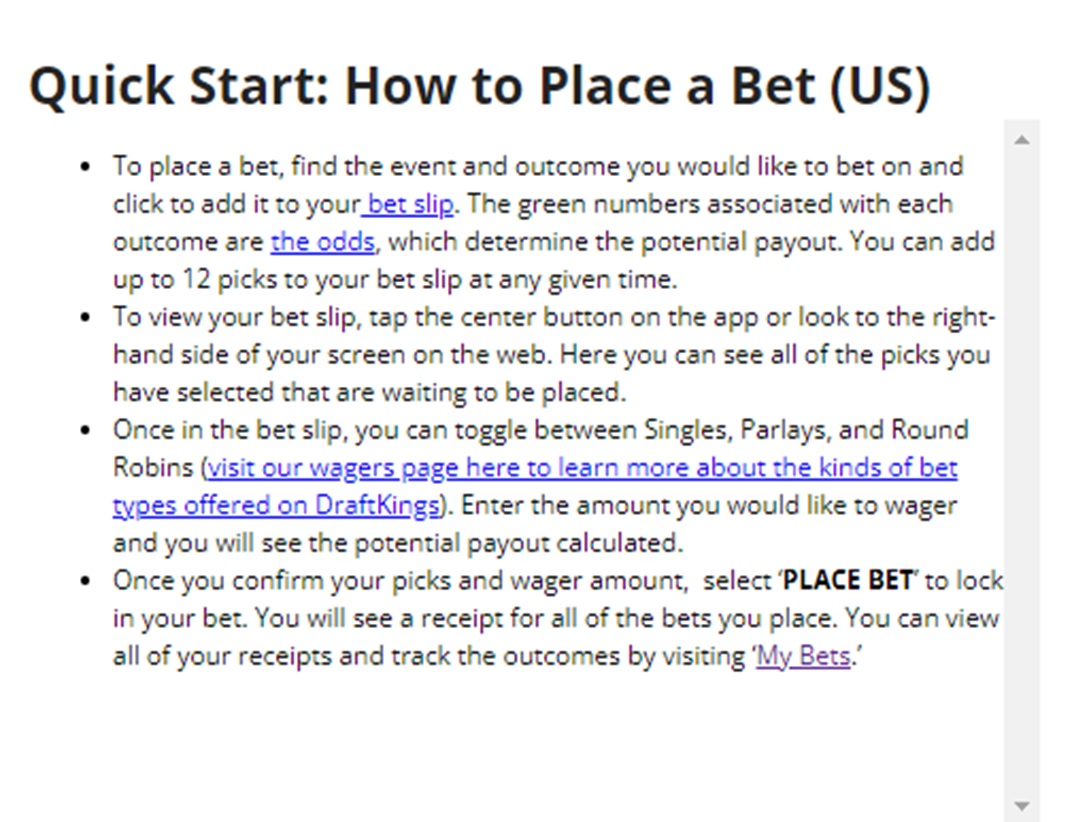

Firstly, let me briefly mention the “Quick Start Guide”, which can be accessed by tapping the “?” icon in the bottom-right corner of the screen.

This feature contains a simple introduction to the DraftKings Sportsbook complete with a detailed sports betting glossary, a breakdown of live betting, a step-by-step guide to placing your first bets, and various other definitions. Think of it as an on-page DraftKings Wikipedia.

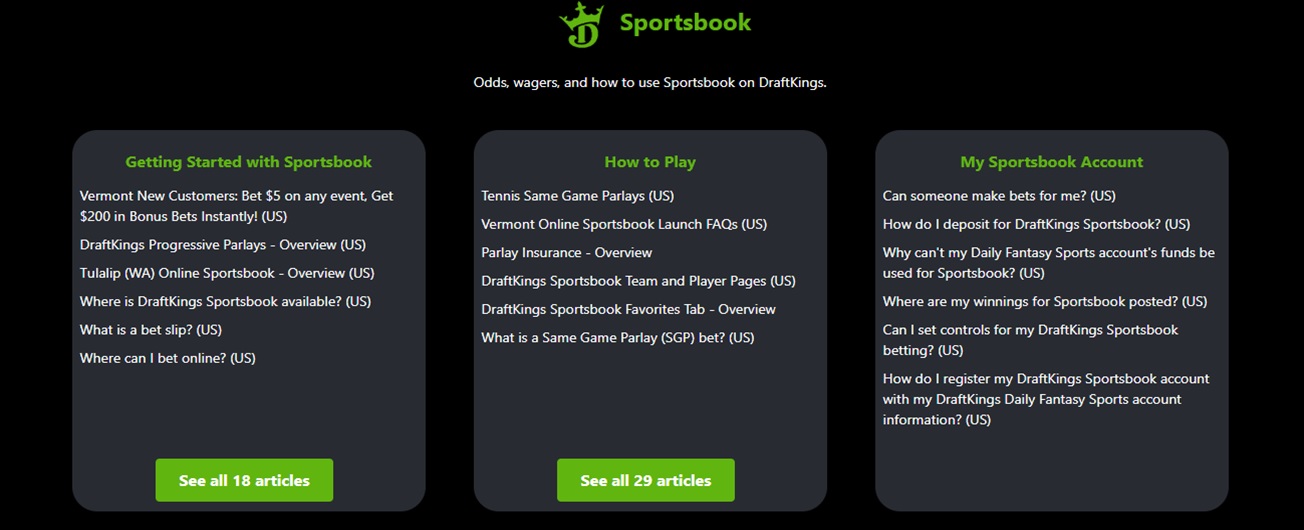

Next up is the DraftKings Help Center – a feature that helped me navigate every nook and cranny of this website.

Every possible question that may come to your mind has already been asked – and answered – in this section. It’s broken down into four subcategories, including Getting Started with Sportsbook, How to Play, My Sportsbook Account, and DK Horses, each including over a dozen detailed articles about the most frequently asked questions and topics.

Finally, there’s the live chatbot feature that you can access from the Help Center by tapping the “How Can We Help” message bubble in the bottom-right corner. It’s not as efficient as speaking to real life agents, but it’s very reliable when it comes to basic questions.

You can also reach DraftKings’ support team by phone at (617) 986-6744 or via email at support@draftkings.com.

DraftKings Sportsbook App Review

It was immediately clear to me that DraftKings knows what its users need and want when I downloaded its sportsbook app.

Sleek, streamlined, and remarkably user-friendly, their sports betting application is a pocket-sized mirror image of its website, featuring all sports markets and betting options, promos and contests, shortcuts, filters, and more.

Separate apps are available for each DraftKings product, including Daily Fantasy Sports, Sportsbook, Casino, Pick6, and DK Live, directly from the draftkings.com website. Just follow this link and tap the app you wish to download.

Sports You Can Bet On

DraftKings covers 20+ sports betting categories, as well as special markets like Primetime Games (like Sunday Night Football), Playoffs, and Championships, including

- Aussie Rules Football

- Baseball

- Basketball

- Boxing

- Cricket

- Cycling

- Darts

- E-sports

- Football

- Golf

- Handball

- Hockey

- Jai Alai

- Lacrosse

- MMA

- Motorsports

- Rugby League

- Rugby Union

- Snooker

- Soccer

- Table Tennis

- Tennis

User Interface and Design

Despite having tons of features, DraftKings managed to build an interface that is as clean and user-friendly as possible. This is largely thanks to the intuitive shortcuts and groups of similar features huddled together; they reduced page-crawling actions to a bare minimum while affording you a clear overview of everything that is even remotely tied to your chosen selections.

Even if you never visited an online sportsbook before, the exhaustive info available in the Quickstart Guide and the Help Center can help you seamlessly navigate this website. The apps are, as I mentioned, identical replicas of the browser-based sportsbook.

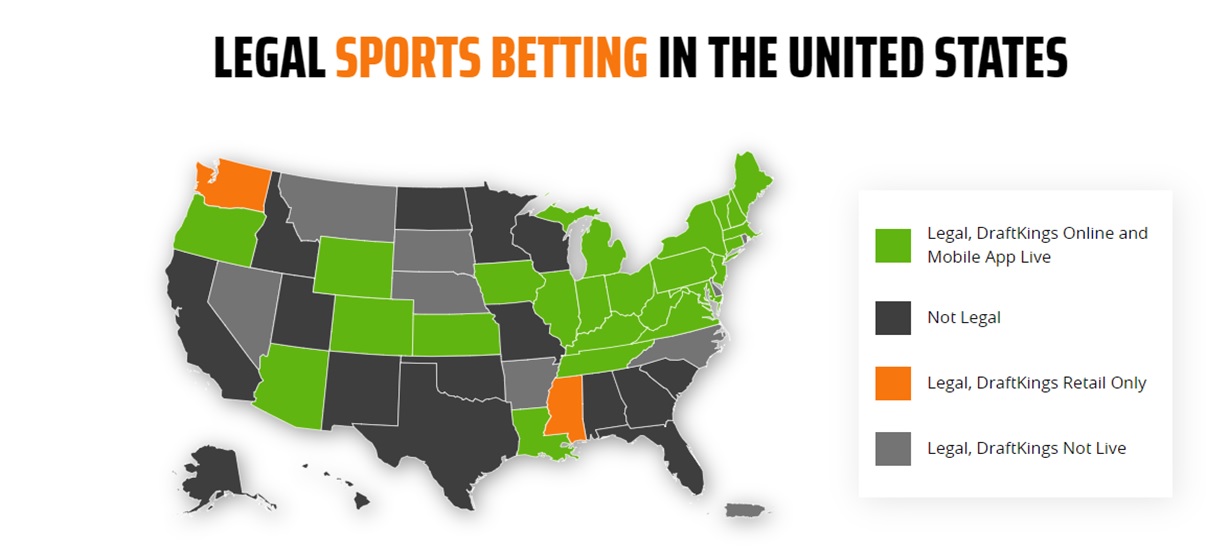

Where is DraftKings Sportsbook Available

DraftKings has a pristine record of operating only in US states where sports betting has been legalized. They’re constantly expanding and are currently available in over 22 states, including:

- Arizona

- Colorado

- Connecticut

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maryland

- Massachusetts

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Oregon

- Pennsylvania

- Tennessee

- Virginia

- Washington

- West Virginia

- Wyoming

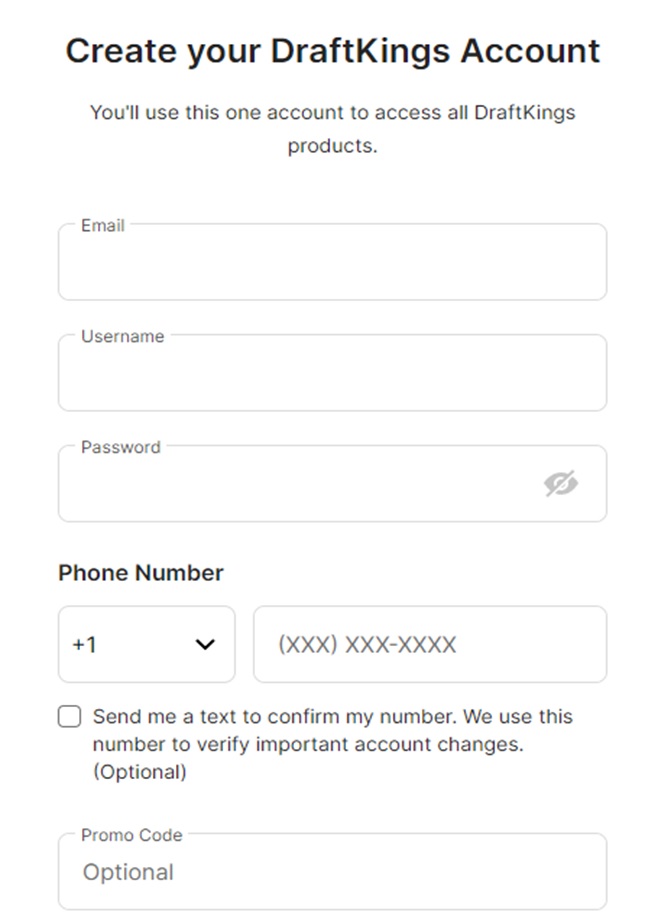

Account Signup and Registration Process

Like virtually everything else at this book, creating an account is super-simple. Just tap “Sign Up” when visiting the official DraftKings website, and fill out the required fields with the following information:

- Provide a valid email address you have access to (important for profile verification);

- Create an original username and password;

- Provide your phone number and tick “Send me a text to confirm my number”;

- Use the code from the verification SMS to continue;

- Enter your full name and last name;

- Provide your address and date of birth;

- Choose your preferred payment method.

To finalize the process, tap “Create Account”. I recommend checking DraftKings Terms and Conditions first since you’ll be required to accept as soon as you create your profile.

Final Verdict

Saying that DraftKings is one of the best sportsbooks in the USA would be an understatement. They’ve got the odds, the market coverage, the promos, support channels, and the reputation of the leading book in the field for a reason, and throughout my 5+ years of testing the platform, I only have words of praise for every aspect of their operation.

From speedy payouts and flexible deposits to regular boosters to gracious rewards in the Dynasty Program, I’ve been generously rewarded for being an active member, and I warmly recommend using our secure links to join DraftKings today.