Best Michigan Gambling Sites

Online sports betting in Michigan is officially here! After months of delays, online betting is finally legal and available in the Wolverine state. Michigan bettors can now wager on these licensed MI sportsbook apps anywhere across the state.

MI online sports betting went live on Jan. 22, 2021, and there are already several online and mobile operators available in the state. Gov. Gretchen Whitmer signed into law a number of gambling expansion bills, which included the Michigan sports betting bill. In addition to sports betting, online poker and MI casino apps and online casinos are now permitted in Michigan. Residents can now wager on their favorite sport or join a Michigan online casino to play some blackjack.

On this page we will look at how Michigan sports bettors can sign up and wager on their favorite sports teams and list the best Michigan sports betting apps.

Best online sports betting apps in MI

- Superb range of sports

- Enticing rewards program

- Extensive catalogs of betting markets

- Accepts deposits as low as $5

- Hefty welcome and referral bonuses

- Available in 22 US States

- Great Mobile App

- Brilliant Welcome Bonus

- Range Of Bet Types

- Massive Choice of Sports

- Daily Odds Boosts

- Convenient Banking

A number of online and mobile operators are now offering sports betting in Michigan, with more on the way. The complete list of available MI betting apps include:

- BetMGM

- BetRivers Sportsbook

- Caesars Sportsbook

- DraftKings Sportsbook

- FanDuel Sportsbook

- Golden Nugget

- Gun Lake Sportsbook

- Four Winds Sportsbook

- FireKeepers Sportsbook

- SI Sportsbook

- Eagle Casino & Sports

Online gambling in the US is growing as more states introduce a legal gambling market. Michigan has joined the list, and online sports betting in the Wolverine State has arrived. Residents can now bet on their favorite sport and benefit from innovative features on mobile apps.

Retail betting has been available in Michigan since back in March 2020, and the desire for more sports betting in Michigan has grown since then. Retail locations such as the MGM Detroit sportsbook located at the MGM Grand Detroit have been successful. It has taken a while for online and mobile sports betting to launch, but the day finally arrived on January 22, with Michigan sports betting apps available for residents to use. The NJ sports betting market has been hugely successful since its inception, and Michigan is hoping to follow suit.

Michigan gambling, in general, is growing, with many bettors wanting to know which sites have the best daily fantasy sports contests or which casino in Michigan has the best sportsbook or odds?

This article covers several topics surrounding sports wagering in Michigan. We look at important aspects of Michigan state betting such as bonus offers, which operators are expected to launch, download apps, and more.

Michigan Sports Betting apps in detail

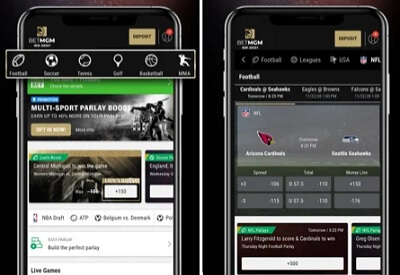

#1. BetMGM Sports app Michigan

Rather than just being known as a major online casino in Michigan, BetMGM wants to be a significant force in the online sports betting market. The operator has made fantastic progress, providing numerous markets to bet on, including all of the significant domestic and international sports. In addition to the most popular sports, you will find niche markets available on the BetMGM sports app.

The company has a retail sportsbook Detroit, at the MGM Grand, which will help with its standing in the state of Michigan gaming industry. The BetMGM sports lounge opened in March 2020 with betting windows and self-service kiosks for players to place their wagers. Michigan bettors are in for a real treat with the features available on the app. From in game wagering to cash out, the app has it all. BetMGM Michigan also run regular promos and price boosts and have one of the best parlay builders out of any Michigan betting apps.

Every time I log into my BetMGM account I am greeted with an exciting new feature to try out. They also offer one of the best rewards programs around and you can quickly collect enough points to benefit from some amazing prizes.

- Superb range of sports

- Enticing rewards program

- Extensive catalogs of betting markets

#2. DraftKings Michigan Sportsbook

Draftkings sports betting is well-known across the United States for providing the best DFS platform going. The operator is a market leader in the states it has entered due to its daily fantasy sports competitions and wide range of betting markets. The operator is now one of the top names in the industry to offer legal sports betting, and the latest DraftKings Sportsbook app is full of features, including live betting, which introduces an element of fun to the online gambling experience.

Using in-play betting, customers can bet on an event as the action is unfolding. The odds and lines available with DraftKings are competitive. The brand always ensures it greets new customers with generous welcome bonuses and promotions, such as an opening free $1,000bet.

I love betting on my mobile, so naturally I am a fan of DraftKings. Their app is top quality. It’s so simple to use, everything is clear and you can find your way around without having experience of using a betting app before. This makes is perfect for people like me who are busy and want to place a bet quickly.

- Accepts deposits as low as $5

- Hefty welcome and referral bonuses

- Available in 22 US States

#3. Caesars Sportsbook Michigan

Caesars Entertainment purchased the William Hill brand in 2020 and since renamed the operator to the Caesars Sportsbook. One of the biggest online gambling brands in the UK has been growing its presence in the United States. William Hill provides a reliable and exciting online and mobile sports betting platform with a wide range of betting markets. Bettors will discover all of the standard types of bets with lines that are competitive within the market.

Some of the daily promotions could be improved, but there is still enough incentive to sign up at this trusted and well-known operator. The William Hill sportsbook entered the Michigan sports betting market thanks to a partnership with Turtle Creek Casino and is now known as the Caesars sportsbook MI.

Caesars are one of the biggest names in the business and their sportsbook app does not disappoint Michigan users will love all of the features on offer including the sports specific bonuses that give you a nice boost when betting on your favorite players and leagues.

- Great Mobile App

- Brilliant Welcome Bonus

- Range Of Bet Types

#4. FanDuel MI Sportsbook

FanDuel, along with DraftKings, has become one of the most prevalent legal sports betting options in the US. The online sportsbook and mobile app are straightforward to use and are pleasing to the eye. FanDuel provides a superb sports betting experience thanks to its plethora of features, such as its single-game parlay offerings. Michigan sports fans will find a huge range of betting options and features on the app. There is cash out, in game betting, price boosts, and access to over 200 games in the casino.

Additionally, the FanDuel sportsbook Michigan offers appealing daily promotions and bonuses, including odds boosts and featured bets. New players can get a $1,000 free bet when signing up. Betting with a licensed book like FD is a far better, safe alternate over an offshore sportsbook like bovada.

FanDuel partnered with the MotorCity Casino to enter the Michigan market.

Download the app on Android & iPhone: fanduel.com/sportsbook

- Massive Choice of Sports

- Daily Odds Boosts

- Convenient Banking

How to Choose the Best MI Sports Betting Apps

If you are new to sports betting, choosing the app most suitable for you can be daunting. Here at GambleUSA we think you should focus on the following categories to determine the best MI sports betting apps.

Bonuses & Promotions

First-time bettors should carefully consider each welcome bonus and other promotions that are offered to them. Some bonuses will instantly be more valuable than others, however, scratch beneath the surface and they may also come with strict wagering requirements. Lucrative ongoing promotions are a good reason to stay loyal to an app, especially if they provide a rewards program that allows you to accumulate points that you can redeem for cash and exclusive experiences.

Security

When you are entering personal and financial information on any website, you want to be reassured you are doing so in a safe environment. Any top betting app in Michigan must offer the highest quality encryption software. Regulators are tasked with monitoring each sports betting app to ensure all the necessary security protocols are in place.

User Experience

The competition in the online sports betting market is huge. Consequently, the quality of the user experience is more important than ever. All bettors must have the ability to navigate seamlessly as they look to place bets, fund their accounts and even live stream contests.

Payment Options

All MI sports betting apps must offer customers a wide range of deposit and withdrawal options. Every operator will allow payments to be made by debit and credit cards, however, there is a desire among bettors for more flexibility and more digital wallets to be available such as Neteller and PayPal. Regarding withdrawals, request minimums are something to consider. The best sportsbooks allow you to request smaller payouts, starting out from as little as $10.

You will also want to factor in payouts speeds. You don’t want to be frustrated waiting around for your funds after the high of scoring a big win. The best apps will process withdrawal requests in 48 hours or less.

Operators Expected To Launch In Michigan

Michigan State is home to passionate sports fans. There are four major professional sports teams in addition to two Big Ten college sports programs in the state. Consequently, Michigan is a hotbed of potential for online sports betting.

This means more operators want to launch in the state to take advantage. But who will be the next to go live in Michigan? Below is a list of sportsbooks that could be available soon:

- Parx Casino

- TBD/FireKeepers Michigan Casino

- TBD/Soaring Eagle Casino

Online sportsbooks require a partnership with tribal casinos. Some of these casinos have available licenses but have yet to announce the operator they are partnering with. Michigan online sports betting is booming and will only grow from here.

Downloading a legal sportsbook app in Michigan

Now that sports betting is legal state-wide, getting a mobile sportsbook is a piece of cake. As long as you are aged 21 or over and have sufficient cell signal, you can easily download a betting app. You don’t need to be in state lines to download any of the apps, but you do need to be in order to physically lay a bet. The Google Play Store and iTunes now have lots of sports betting apps available. Finding a reliable is harder than downloading the app. As long as you use any of the books recommended on this page, you can’t go wrong.

We always suggest signing up on the mobile site first before downloading any of the apps. This way you can be sure to lock in your welcome bonus when creating an account. It is then a matter of opening your app store and searching by name. Operators like BetMGM and FanDuel have 1 app for all states, others like BetRivers have state-specific apps, so make sure you choose the right one.

Features you will find on the apps

These days, you can do a lot more on a gambling app than just place a bet. Yes, betting is the main part of the app, but it’s not just a matter of placing a single bet. You can get all these exciting features too:

- Cash Out

- In Game betting

- Live streaming

- Rewards programs

- Free to enter competitions

- Free Bets & promotions

- Safe & secure banking

- Casino access

As of yet, betting on esports is not yet a market or feature you will find on any licensed MI sportsbook.

How Michigan Sports Wagering Works

When Gov. Gretchen Whitmer signed the Lawful Sports Betting Act in 2019, legal it started the journey for legal sports betting in Michigan. The biggest trend in the sports betting industry in the United States is mobile sports betting. For example, in New Jersey, mobile sports betting accounts for 80% of the overall number of wagers placed, and it is likely to be a similar story in Michigan.

All states with a legalized sports betting industry have opened up retail sportsbooks first, and Michigan is the same. This is because the licensing process for online betting is a longer, more complicated process. Retail sportsbooks are essentially the sports betting arm of casinos in Michigan. To launch a mobile sports betting app, you must have the required certification and approval from the Michigan Gaming Control Board for geofencing and age verification.

The legal gambling age in Michigan is 21, and anyone that age or older located within state lines can place a bet. Proving you are in state lines is done by geolocation (player location checks) this needs to be enabled on your smartphone so you can confirm your location inside MI borders. All betting apps in Michigan are overseen and regulated by the Michigan Gaming Control Board (MGCB). All online sports betting legal sites must adhere to the MGCB rules and regulations.

Downloading and creating an account on a betting app is straightforward. All of the best apps are available for both iOS and Android devices, and the download process takes minutes. When creating your account on a Michigan sports betting app, you will need to provide information such as your name, address, email, date of birth, and the last couple of digits of your Social Security number. This is to verify you are at least 21 years old.

You can sign up to a Michigan online sports betting site from anywhere as long as you have a stable internet connection. You must deposit some funds into your account before playing, but the apps have numerous efficient payment methods to ensure that you can do so quickly.

Types Of Bets At Michigan Sportsbooks

The Michigan law states the types of legal bets in the state, such as over-under, moneyline, and straight bets. The range of bet types available at Michigan sportsbooks includes:

- Moneyline

- Teasers

- Over/Under

- Single-game bets

- Straight Bets

- Props

Moneyline wagers are the most common, as you are just betting on which team you think will win. However, there are more ‘exotic’ bets, such as an over/bet, which sees the bettor predict the total score of both teams added together. Additionally, a prop bet is another exciting betting option as it allows players to bet on possible events in a game, such as a player scoring the next TD in an NFL game.

Live Betting

Live wagering, otherwise known as ‘in-play’ is one of the fastest-growing segments of the US sports betting market. These wagers are placed once the game has already started. Operators have a live feed that updates the odds and provides the player with accurate data reflecting what is happening during the game.

Live betting involves a considerable amount of fan engagement and is seen by many as more exciting than traditional betting. Bettors can choose to wager on what the score will be at half-time, who will score the next touchdown, or who will get the next free-kick.

In-game betting options include point spreads, totals, and moneylines. Additionally, there are betting markets specific to in-game betting. For example, in baseball, you can bet on who will score a particular number of points in the Detroit Lions game. Please note that in-game odds and prop bets are not permitted for college sports.

Sports Betting Markets In Michigan

Online sportsbooks and retail sports betting locations in the state will give Michigan bettors the chance to bet on all of the most prominent international and domestic sports, including:

- Football (NFL, FBS NCAA)

- Basketball (NBA)

- Baseball (MLB)

- Ice Hockey (NHL)

- Soccer (Major League Soccer, English Premier League, German Bundesliga, Spanish La Liga, Italy Serie A, UEFA Champions League)

- Boxing

- Auto Racing

- Tennis

- Golf (PGA, LPGA, European Tour, Champions Tour)

Some sportsbooks will offer more niche sports options such as darts, cricket, and Aussie rules football.

Michigan Sports Betting Rules & Regulations

Michigan sports betting sites were legalized in January 2021. The Michigan Gaming Control Board was chosen to oversee and regulate all commercial and online gaming in the state, and if you want to legally wager on sports, you must meet the following requirements:

- be physically located within state lines

- be at least 21 years old

- enable geolocation settings on your mobile device

You can create an account outside of Michigan but to wager on sports you must be physically located in the state. Michigan residents can claim gambling losses on their tax return, although they must declare 25% of the winnings to the IRS. You are free to bet on local college sports teams, however, betting on esports or politics is not permitted.

Michigan Sports Teams to Bet on

Detroit Lions

The NFL team that represents Michigan is the Detroit Lions. The Lions are a storied franchise in the Wolverine State and, although they haven’t achieved enormous success, still boast a passionate fanbase. The Lions play their home games in Ford Field in downtown Detroit which has been its home since the 2002 season. The team competes in the NFC North, where it plays against the Green Bay Packers, Chicago Bears, and Minnesota Vikings twice a year. The Lions also traditionally host a Thanksgiving game and take the early primetime slot for that Thursday.

Players can bet on a full slate of wagers with their hometown Lions. Multiple sportsbooks offer plenty of prop-bets for every NFL game, including the Lions, in addition to providing traditional bets like spreads. The Lions agreed to a partnership with BetMGM to make it the franchise’s official online sports betting partner.

As mentioned above, the Lions haven’t been very successful. They are one of only f our teams to never play in a Super Bowl. However, if you feel their luck is changing, you could wager on the Lions to make a Super Bowl by making a futures bet on any significant sportsbook.

Detroit Redwings

Whereas the Lions haven’t enjoyed much success throughout their history, the same cannot be said for the Redwings. The Redwings are Detroit’s most successful team and compete in the National Hockey League. The team boasts 11 Stanley Cup trophies, an impressive amount, with the latest one coming in the 2007-2008 season. They have suffered a drop-off in talent over the past decade, but Detroit still remains one of the country’s best hockey towns.

The team plays at the Little Caesars Arena in Detroit, which also plays host the Pistons. The Redwings play plays in the Atlantic Division in the Eastern Conference. NHL is a prominent betting option for bets in Michigan.

Detroit Pistons

There is currently one NBA team in Michigan, which is the Detroit Pistons. The Pistons were one of the most successful teams of the early 2000s and are a beloved franchise in Michigan. The team claimed championship success in 1989, 1990, and most recently, 2004. Additionally, the team has sponsorship deals in place with both FanDuel and DraftKings.

The Pistons play in the Eastern Conference and are going through a rebuild as they look to reclaim former glories. The ownership group led by Tom Gores is seeking to build a strong team that can compete at the top of the conference.

The Pistons will receive a lot of betting attention in Michigan. Because the NBA offers the most number of wagers next to football, this will be a major hub of sports betting activity for the Wolverine State.

Michigan Wolverines

The University of Michigan is steeped in history. They have a total of 16 national titles in football (11 claimed and five unclaimed). Additionally, they have 3 NIT Tournament championships and an NCAA Tournament championship.

The University of Michigan can be found in Ann Arbor. The football team plays at the Michigan Stadium, which has a fantastic 107k capacity, while the basketball team plays at the Crisler Center.

The Michigan Wolverines take up a lot of wagering handle in the Wolverine State and are an attractive option for collegiate betting.

Detroit Tigers

Anything regarding basketball in Michigan revolves around the Tigers. The team plays in the American League Central Division. Established in 1894, the Tigers are the most historic team in Michigan. They play their home games in Comerica Park, and they have four World Series titles and 11 AL Pennants.

Along with other Detroit teams, the Tigers have struggled in recent years after losing the 2012 World Series to the Giants. However, they are undergoing a transitional phase as they seek to build a solid team and give Michigan bettors something to bet on when it comes to professional baseball.

Michigan State Spartans

The Michigan State Spartans boast one of the most successful football and basketball programs in the United States. The Spartans have two NCAA Tournament wins and six national titles in football. The football team plays out of Spartan Stadium while the basketball team plays out of the Breslin Center.

It is entirely legal to bet on Michigan State teams while located within state lines as there are no restrictions on in-state collegiate betting.

Banking Options In Michigan

Before you can take advantage of that

free bet and first deposit bonus offer, you will need to add funds to your account. This is safe and secure as legal and regulated online sports betting operators ensure there are numerous ways to deposit and withdraw funds.

Some of the most common payment methods include:

- Debit/Credit Cards

- E-wallets (PayPal, Neteller, Skrill)

- Bank Transfers

- Prepaid Cards

- Cash At Casino Cage

In the majority of cases, the method you choose to deposit with the same way you withdraw from Michigan sports betting apps. Typically, there will be more deposit options than withdrawal methods. If there is no suitable way for you to cash out your winnings, get in touch with the operator. However, in most cases, withdrawals are made instantly.

Retail Betting In Michigan

When sports betting officially became legal in 2019, the law called for online and retail wagering. For retail betting, you will find sportsbooks at many of the state’s casinos:

- Gun Lake Casino

- Four Winds Hartford

- Four Wings Dowagiac

- Four Winds New Buffalo

- Greektown Casino Hotel

- Leelanau Sands Casino

- Islands Resort & Casino

- MGM Grand Detroit

- FireKeepers Casino Hotel

- Motor City Casino Hotel

- Turtle Creek Casino & Hotel

- Little River Casino & Resort